Cost allocation methods and when and where to use them

For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point. Since these parts ofthe chicken have relatively little value, they tend to fall into the category of by-products. Suppose the after split-off costs, such as collecting and packagingthe parts…

For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point. Since these parts ofthe chicken have relatively little value, they tend to fall into the category of by-products. Suppose the after split-off costs, such as collecting and packagingthe parts are estimated to be $25 for 2,000 pounds of feet, beaks and gizzards.

Would you prefer to work with a financial professional remotely or in-person?

If the driver for a cost cannot beidentified, or identified easily, then an allocation scheme perceived to be “fair and equitable” might be used. A search for a “fair andequitable” allocation method often leads the system designer to the “ability to bear” the cost logic. Some examples that most readers canrelate to include allocating the costs of federal, state and local governments to their constituents. Federal and state income taxes are based on the”ability to bear” logic, i.e., they are progressive in that those with higher incomes pay a higher percentage of their incomes than those with lowerincomes. Whether either of these taxallocation schemes is also “fair and equitable” is subjective and therefore controversial. For example, those who pay little or no income taxestend to receive the greatest benefits in the form of welfare and other government transfer payments.

Step Four: Allocate Variable Costs Among Departments or Projects

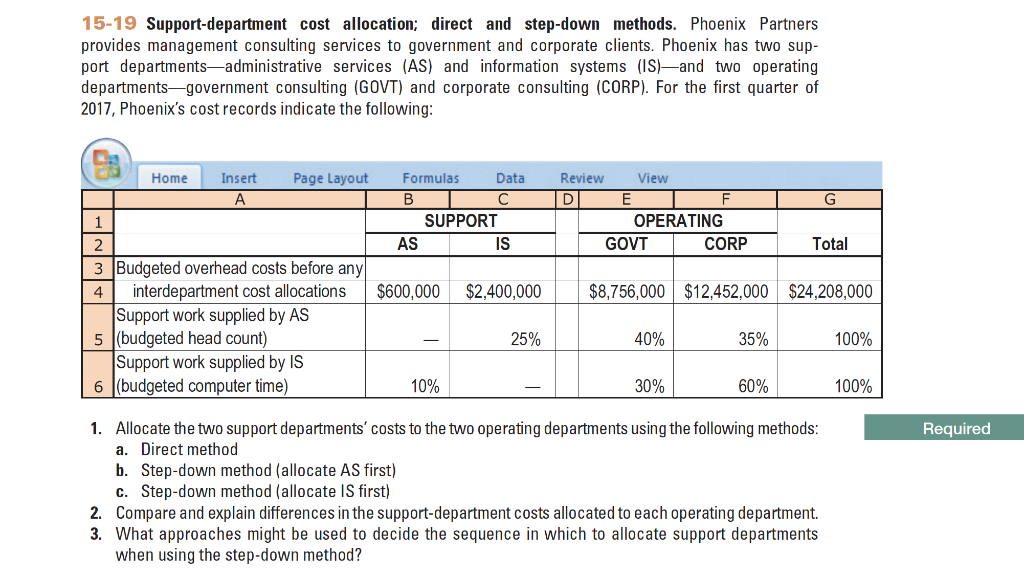

A plant wide rate based on machine hours would provide accurate product costs.c. Activity based rates would be needed to provide accurate product costs since direct labor is not used in proportion to machine hours.d. The step-down method is a technique used in cost accounting to allocate service department costs to production departments in a systematic manner. This method aims to ensure a more accurate distribution of costs, leading to better decision-making and budgeting.

Great! The Financial Professional Will Get Back To You Soon.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Below shows how the variable costs change how to change your tax filing status as the number of chairs made varies. We will briefly consider one approach that is similar to the cost reduction method used for scrap (See Chapter 4).

Is there any other context you can provide?

While some of the activity measures may be related toproduction volume, other non-production volume related activity measures are also used. The two stage activity basedcosting approach is illustrated in Chapter 7 and focuses on eliminating the distortions that tend to occur when the traditional two stage approach is used. When a department produces (or partially produces) many different products and some of the products consume different indirect resources in different proportions, a moreinvolved method is needed to provide accurate product costs. For example, if Product X consumes 30 percent of the power, 15 percent of the engineering workand 20 percent of the maintenance activity in Department A, then a single departmental overhead rate would distort product costs. This is because a singleactivity measure, or allocation basis can only represent one of these percentages.

- The term “by-products” refers to a sub-category of joint products that have relatively insignificantsales values as a proportion of the value of the entire group from which they are derived.

- In addition to the allocations to Cutting and Assembly, the Power Department allocates $11,535 toMaintenance and $5,768 to itself, while the Maintenance Department allocates $3,817 to the Power Department and $5,726 to itself.

- Examples include top management salaries, internal auditing, company legal and medicalfacilities, advertising designed to promote the company image, public relations and landscaping around the facility.

- The following is an overview of how to allocate costs and some tips on what you should take into consideration when doing so.

- A solution like Phocas will integrate directly with your business systems—from ERP and financial software to human resource and production tracking tools.

If there is still a tie, thenchoose the department with the largest dollar amount of service provided to the other service departments. In the step-down method, no costs are allocated (orreallocated) back to a service department once the service department’s costs have been allocated. The purposes of cost allocations are closely related to the purposes of information systems outlined in Chapter 2 (See Exhibit 2-4 for a review). Cost allocations are needed to value inventory for external reporting purposes, for planning and monitoring thecost of activities and processes, and for various short term and long term strategic decisions. Some examples include decisions to “make or buy”sub-components and services, how to price products and services, when to add or discontinue various products and services and when to expand or contract thesize of a segment of the company. In addition,since cost allocation methods are components of the overall performance evaluation system, cost allocations tend to influence the behavior of theparticipants within the system.

Headcount cost allocation works by dividing costs based on the number of full time employees (FTEs) in each department. In business, this method often suits costs like human resource services or office supplies, where usage typically scales with team size. In this scenario, a department with 30% of the company’s employees would shoulder 30% of these shared expenses. Variable costs fluctuate with your business activity and market conditions, rising and falling as your operations change.

Since X1 consumed 9/10 of the machine time inthe Cutting department, (i.e., 3,960÷4,400) it seems logical that X1 should receive 90 percent of the overhead costs. Direct costs (D) refers to the costs that are incurred within each department. Thus, the equations showthat the total costs of a producing department includes the department’s direct cost (Di), plus the allocations from the various service departments(i.e., the sum of [(Kji)(Sj)]). The sequence in which the service departments are allocated usually affects the ultimate allocation of costs to the production departments, in that some production departments gain and some lose when the sequence is changed. The distinction between the second and third reasons is important in the context of fixed versus variable costs. The manager should ignore the service department’s fixed costs if these costs will not be affected by the manager’s decision.